Understanding the PAYDEX Score and its Importance

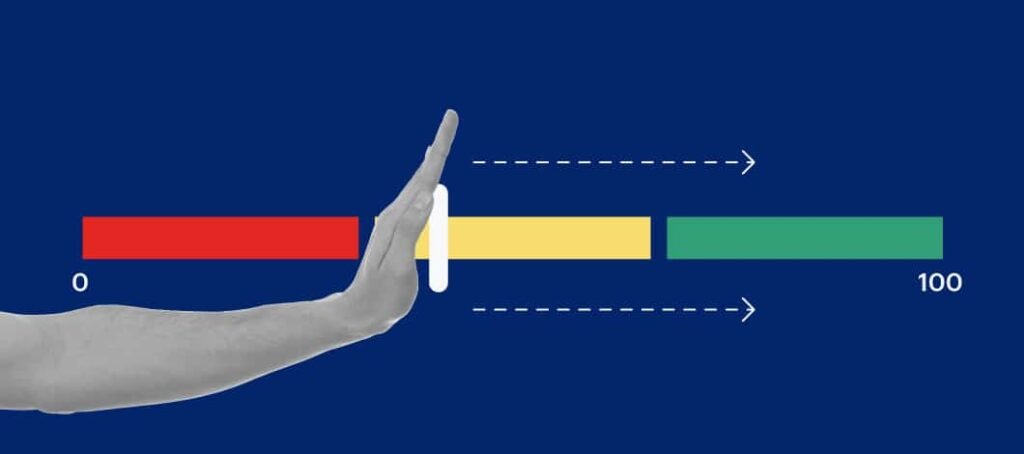

The PAYDEX score is a crucial metric in the business credit landscape, serving as an indicator of a company’s payment performance. Developed by Dun & Bradstreet (D&B), this score ranges from 1 to 100, with a score of 80 or above signaling prompt payment history. This score plays a significant role in determining a business’s ability to secure financing, negotiate with suppliers, and establish credibility with potential partners and customers. Specifically, the score is calculated based on the timeliness of payments made by the business over a specified period, taking into account various factors such as days past due and payment trends.

A strong PAYDEX score can greatly enhance a company’s reputation and operational capabilities. Businesses with scores of 80 or higher are often viewed more favorably by banks and lending institutions, as they signal lower risk. Consequently, these businesses may receive better financing options, such as lower interest rates or larger credit lines, which can help fuel expansion or address cash flow needs more effectively. Furthermore, a robust PAYDEX score can empower businesses to negotiate more favorable terms with suppliers, allowing them to obtain materials or services at reduced costs or with extended payment terms.

Real-world examples illustrate the benefits of maintaining a high PAYDEX score. For instance, a small manufacturing firm with a PAYDEX score of 82 was able to secure a $250,000 loan from a local bank, enabling it to increase production and hire additional staff. This scenario demonstrates how a favorable credit score can directly influence a company’s growth trajectory. Additionally, companies showcasing high PAYDEX scores tend to attract more customers, as they are perceived as trustworthy and financially stable. In summary, understanding the PAYDEX score and achieving a score of 80 or above is vital for businesses seeking to unlock new opportunities and establish long-term success.

Strategies for Improving Your PAYDEX Score

Improving your PAYDEX score to an impressive level of 80 or above can significantly enhance your business’s opportunities for growth and access to credit. One of the most effective strategies is to implement best practices for managing payment terms with your suppliers and vendors. Establishing clear expectations about payment timelines helps to cultivate favorable relationships and encourages adherence to payment schedules.

Timely payments play a crucial role in fortifying your PAYDEX score. It is essential to prioritize paying bills on or before their due dates. This not only strengthens your credit profile but also demonstrates to suppliers your reliability as a business partner. Additionally, consider setting up automated payments for recurring expenses. Automating these transactions can eliminate the risk of forgetting to make payments, ensuring you maintain a positive payment history.

Engaging with your creditors and vendors can also reinforce positive payment behaviors. Open communication about your payment practices and discussing any potential challenges fosters understanding and can lead to more flexible terms. These relationships can be instrumental in negotiating better terms or even securing additional credit lines for your business needs.

Furthermore, leveraging professional services to enhance your business’s credit profile can be beneficial. Experts in business credit can provide tailored plans that address your specific needs, ensuring that you are pursuing the right strategies effectively. They can also assist in deciphering credit reports and scoring models, giving you insights that allow for informed decision-making.

Regularly monitoring your PAYDEX score is another strategy to maintain and improve your creditworthiness. Consider conducting periodic credit assessments to identify areas for improvement and to verify all information is accurate. Keeping a close eye on your business credit helps you remain proactive in achieving your goal of an 80 PAYDEX score, while also providing valuable data to fine-tune your financial strategies.