What is Paydex Score and Its Importance for Businesses

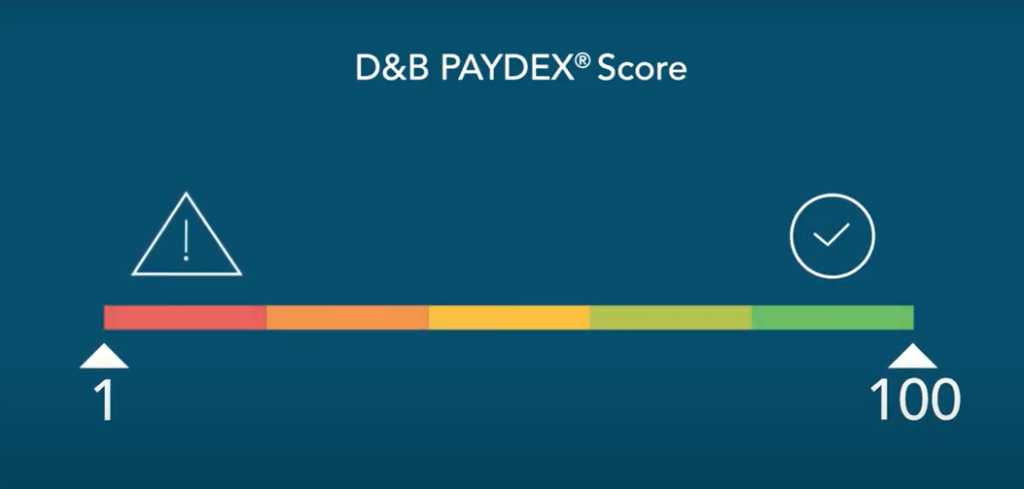

The Paydex score is a unique numerical representation of a business’s payment behavior and creditworthiness, developed by Dun & Bradstreet (D&B). This score ranges from 1 to 100, with a score of 80 or above indicating that a company consistently pays its bills on time or even ahead of schedule. The calculation of the Paydex score is primarily based on the payment history reported by suppliers and creditors, focusing on the timeliness of payments rather than the amount owed. Therefore, businesses that prioritize prompt payment are rewarded with higher Paydex scores, which can significantly impact their overall credibility in the commercial landscape.

A strong Paydex score not only demonstrates a company’s reliability but also serves as a critical factor in determining access to favorable financing options. Lenders often review the Paydex score as part of their risk assessment when considering applications for credit or loans. A higher score signifies lower risk, making it more likely for businesses to secure loans at better interest rates and terms. Furthermore, suppliers and vendors are more inclined to establish advantageous terms with companies that exhibit a solid Paydex score, potentially leading to extended payment terms or discounts on services and products.

The implications of maintaining an inadequate Paydex score can be detrimental for any business. A score below 80 can signal to potential partners and customers that a company may struggle to meet its financial obligations. Consequently, this can result in lost opportunities for contracts, higher costs of borrowing, and strained supplier relationships. It is essential for businesses to monitor their Paydex scores regularly and work towards improving their payment practices. By doing so, companies can achieve a score of 80 or higher, thereby enhancing their market reputation and financial stability.

Strategies for Enhancing Your Paydex Score

Improving your Paydex score to a level of 80 and above is crucial for securing favorable business financing and establishing credibility with suppliers. One of the most effective strategies involves the timely payment of invoices. Ensuring that all payments are made on or before the due date significantly reflects positively on your creditworthiness. By setting reminders or utilizing automated payment systems, businesses can enhance their chances of maintaining a high Paydex score. Consistency in meeting financial obligations not only assists in building a robust score but also fosters trust with creditors.

Another key strategy to enhance your Paydex score rests in cultivating strong relationships with suppliers and creditors. Open communication regarding payment terms and any potential delays can mitigate risks of negative reporting. Establishing goodwill through reliability is essential; suppliers may be more lenient if they recognize consistent punctuality in payment. Furthermore, maintaining a diverse range of suppliers can also be beneficial, as it demonstrates financial stability and a reduced dependency on any single source.

Regularly reviewing and updating your credit profiles is equally important. Businesses should take the time to examine their credit reports to ensure accuracy. Discrepancies or outdated information can adversely affect your Paydex score, so it is crucial to address any inaccuracies immediately. Engaging with financial experts for personalized coaching can provide tailored strategies that tackle specific business challenges. These professionals can analyze your financial habits and instruct on optimizing practices tailored to your industry.

Lastly, leveraging various tools and resources designed to monitor Paydex scores can ensure businesses remain informed about their credit health. Using software and applications that track payments and score changes can help proactively maintain a score of 80 or higher. By integrating these strategies into your financial practices, you position your business favorably within the credit landscape.