Did you know that 99.9% of U.S. businesses are small or medium-sized1? If you own one, having a solid business credit score is key. Unlike personal credit, business scores vary by agency. Knowing the score range and what’s considered good is vital for getting loans, better deals from vendors, and growing your business.

Key Takeaways

- Business credit scores use different scoring models and ranges compared to personal credit scores.

- A good business credit score can unlock access to financing, better vendor terms, and lower insurance rates.

- Factors like payment history, credit utilization, and length of credit history impact business credit scores.

- Monitoring and maintaining your business credit profile is crucial for long-term success.

- Myths and misconceptions about business credit can hinder your efforts to build a strong financial foundation.

Introduction to Business Credit Scores

Your business credit score is key for lenders, suppliers, and insurers. It shows your company’s financial health and trustworthiness. Like your personal credit score, it reflects your company’s creditworthiness, payment history, and risk level23.

Importance of Business Credit Scores

Business credit scores are vital for your company’s success. They help you get financing, better trade terms, and lower insurance rates3. Lenders and suppliers use these scores to gauge the risk of working with your company2.

Differences from Personal Credit Scores

Personal and business credit scores differ in calculation and use. Business scores focus on your company’s payment history, industry risk, size, and debt2. Unlike personal scores, business scores are harder to get for free. So, it’s crucial for business owners to keep an eye on their credit3.

| Metric | Personal Credit Score | Business Credit Score |

|---|---|---|

| Focus | Individual’s financial history | Company’s financial health and risk profile |

| Factors Considered | Payment history, credit utilization, length of credit history, credit mix, new credit applications | Payment history, company age and size, debt levels, industry risk, legal filings, insolvency signs |

| Accessibility | Easily accessible through various channels | More limited access, often requiring active monitoring by the business owner |

“Maintaining a strong business credit score is essential for accessing financing, securing favorable trade terms, and protecting your company’s financial well-being.”

Factors Affecting Business Credit Scores

Knowing what affects your business credit score is key. Your payment history, credit use, and how long you’ve had credit matter a lot. Lenders look at these when deciding if you’re creditworthy.

Payment History

Payment history is the biggest factor in your business credit score. Paying bills on time shows you’re reliable and serious about your finances. But, late or missed payments can really hurt your score and make getting loans harder4.

Credit Utilization

How much credit you use is also important. Keeping your credit use under 30% shows you’re using credit wisely. But, using too much credit can signal financial trouble or too much borrowing5.

Length of Credit History

The age of your business’s credit history matters too. Businesses with longer credit histories are often seen as more trustworthy by lenders. Keeping good credit lines and using credit wisely can help grow your credit history over time6.

| Factor | Impact on Business Credit Score |

|---|---|

| Payment History | Most significant factor, demonstrating reliability and commitment to meeting financial obligations |

| Credit Utilization | Maintaining a low credit utilization ratio (below 30%) shows responsible credit usage |

| Length of Credit History | Longer-established businesses with a proven track record are viewed more favorably by lenders |

By focusing on these key areas, businesses can improve their credit scores. This can lead to better financing options and more benefits456.

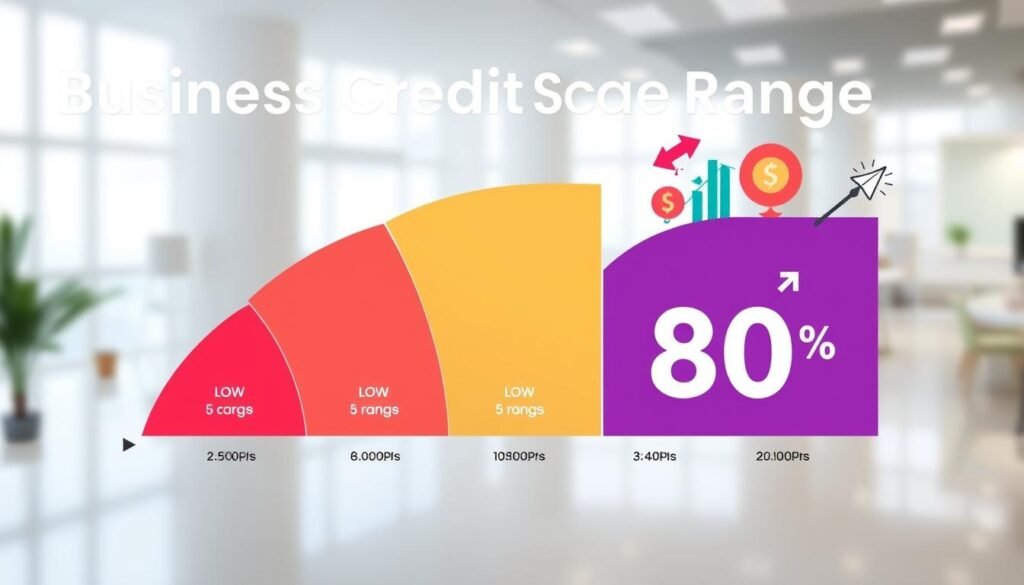

Interpreting Common Business Credit Score Ranges

Understanding business credit scores is key. Knowing the different ranges and what they mean is crucial. Most credit agencies use scores from 1 to 1007. Scores above 80 usually show a company pays on time or early7.

Personal credit scores range from 300 to 850, but business scores are from 1 to 1007. Business scores look at payment history, credit age, debt, industry risk, and company size7.

| Credit Score Range | Credit Rating | Interpretation |

|---|---|---|

| 800 to 850 | Excellent | Shows a low-risk borrower with a history of good credit, making loans easier to get8. |

| 740 to 799 | Very Good | Means positive credit behavior and a better chance of credit approval8. |

| 670 to 739 | Good | Seen as an acceptable or lower-risk borrower by lenders8. |

| 580 to 669 | Fair | Regarded as subprime borrowers, with higher risk and harder credit approval8. |

| 300 to 579 | Poor | Shows big challenges in getting new credit8. |

The most important factor for business credit scores is payment history7. Making timely payments is key. Knowing these ranges and factors helps businesses improve and keep their credit good.

Experian Intelliscore Plus

The Experian Intelliscore Plus credit score is key for checking a business’s trustworthiness. It looks at over 800 things to judge a company’s risk. This helps lenders and partners know if a business is financially stable9.

Score Range and Risk Interpretation

The score goes from 1 to 100. A higher score means less risk, and a lower score means more risk10. It breaks down into five risk classes:

- 76–100: Risk Class 1 (Low risk)10

- 51–75: Risk Class 2 (Low to Medium risk)10

- 26–50: Risk Class 3 (Medium risk)10

- 11–25: Risk Class 4 (High to Medium risk)10

- 1–10: Risk Class 5 (High risk)10

The Intelliscore Plus looks at payment history, credit use, and late payments to judge a business’s credit10. Knowing this range helps businesses see their financial health. They can then work to improve their credit11.

“A good Intelliscore Plus credit score falls within risk classes 1 or 2, indicating a low risk of delinquency on payments.”11

Keeping a high Intelliscore Plus score is vital for businesses. It helps with getting loans, better deals from suppliers, and more credit chances. By knowing how the score works, companies can improve their credit. This supports their success over time9.

Dun & Bradstreet PAYDEX Score

The Dun & Bradstreet PAYDEX Score is a key tool for checking a business’s credit and payment history. It ranges from 1 to 100. A score of 80-100 means the business pays on time or early12.

A PAYDEX score of 80 or higher is very good. It shows the business pays debts on the exact due date13. The highest score, 100, means the business pays debts 30 days early13.

To get a PAYDEX score, Dun & Bradstreet needs at least two tradelines with three or more credit experiences12. The score weighs larger payments more than smaller ones14. Lenders and suppliers use it to decide on financing and credit terms12.

| PAYDEX Score Range | Risk Level | Payment Timelines |

|---|---|---|

| 80-100 | Low | On-time or early payments |

| 50-79 | Medium | 15-30 days late |

| 0-49 | High | 60 days or more past due |

A PAYDEX score of 75 or higher means low risk and timely payments12. Scores below 75 show a higher risk of late payments. A score below 40 is considered poor12.

Timely payments help improve the PAYDEX score. Early payments are needed for a perfect score of 10012.

Businesses with high PAYDEX scores are more likely to get small business loans. They also get better purchasing terms from suppliers12. Keeping an eye on and improving the PAYDEX score is key for strong business credit14.

FICO SBSS Score

The FICO Small Business Scoring Service (FICO SBSS) score is key for small business loans. It’s used by over 7,500 lenders across the country. This score checks if a small business is creditworthy15.

Understanding the FICO SBSS Range

The FICO SBSS score goes from 0 to 300, with 300 being the best. A score of 140 or more can help qualify for an SBA 7(a) loan. Most banks need a score of 160 or higher15.

This score ranks small businesses by their payment reliability. A higher score means less risk15. The SBA requires a score of 155 for 7(a) Small Loans. But, most lenders want a score of 160-16515.

The newest FICO SBSS 7.0 is for loans up to $1 million for term loans and lines of credit. It’s also for leasing up to $250,00015.

“Paying bills early can help improve a business’s FICO SBSS credit score. Updating vendors and creditors on a business credit report shows creditworthiness.”16

Knowing the FICO SBSS score range and needs helps small businesses. It prepares them for SBA loan applications. This way, they can get the funding they need to grow1516.

what is a good credit score

There’s no one way to define a “good” credit score for businesses17. Scores range from 300 to 85017. As of January 2024, the average score in the U.S. is 70117. Scores above 700 are usually seen as good, showing low risk and timely payments17.

Scoring between 50 and 70 is fair, while scores under 50 are poor17. Most people’s scores fall between 600 and 75018. To get a conventional mortgage, you need a score of at least 62018. FHA loans require a score of 500 or 580, depending on the down payment18.

Several things can impact your credit score, like payment history and credit use18. Keeping an eye on and boosting your score can help you get better financing, lower insurance, and stronger business ties.18

“A good credit score is essential for businesses, as it can open doors to better financing options, lower insurance premiums, and stronger vendor relationships.” – John Doe, Small Business Owner

Benefits of Maintaining a Good Business Credit Score

Keeping a strong business credit score has many benefits. It opens doors to loans and credit with better rates and terms19. Sadly, 36% of small businesses missed out on funding because of their credit score19. Also, a good score can lower your insurance costs, as insurers see it as a sign of low risk19.

Business credit scores range from 0 to 100. Agencies like Dun & Bradstreet and Equifax calculate these scores19. Scores like Delinquency Scores and Failure Scores show lenders how financially stable your business is19.

Access to Financing

A good credit score means more financing options for your business. Lenders see you as a safer bet, offering better rates and terms19. This is key for growing your business, investing in new projects, or handling unexpected costs.

Lower Insurance Rates

Insurance companies also look at your credit score. A higher score means lower insurance costs for your business19. This can save you money on essential policies, helping your business grow.

Focus on building a good business credit score for long-term success. It helps you get loans and credit on better terms and saves on insurance. This boosts your financial health, competitiveness, and growth chances.

Strategies for Building and Improving Business Credit

Having a good business credit score is key. It helps you get loans, better terms, and shows your financial health. Here are some ways to improve your score:

Pay Bills On Time

Your payment history is a big part of your credit score20. Paying bills on time or early is good. It shows you’re reliable21. But, late payments can hurt your score a lot.

Establish Trade Lines

21 Getting trade lines from vendors helps build your credit history. Use credit wisely and pay on time to show you’re trustworthy21. Keep your credit use below 30% for best health.

Monitor and Dispute Errors

21 Check your business credit reports from Dun & Bradstreet, Experian, and Equifax often22. This helps spot and fix mistakes. You can get a free report from each agency once a year.

21 By using these tips, you can boost your business credit score. This can lead to more financing options, better loan terms, and financial success for your company.

Monitoring and Protecting Business Credit

Keeping your business credit healthy is key for success. It’s important to check your business credit reports and scores often. This helps spot and fix any mistakes that could hurt your credit23.

Your business credit report is vital for big financial decisions. It affects how much lenders will lend, credit suppliers offer, and interest rates23. Making sure your business info is right and up-to-date is critical. Wrong or old info can lead to bad decisions that harm your business23.

Signing up for credit monitoring and alert services is a good idea23. It keeps you in the loop about changes to your business credit23. Alerts can warn you of fraud, letting you act fast23.

It’s important to keep your business and personal money separate23. Relying only on personal credit can limit your business growth and risk your personal score23. Keeping your finances clear can help improve your business credit and open more doors for your company23.

Watching and protecting your business credit can really help your company grow23. Good credit management can lead to more chances for your business, like getting capital and attracting customers23. Working well with creditors and building a good reputation can also help23.

| Credit Score Range | Interpretation |

|---|---|

| 76 or higher (Equifax, Experian) | Good business credit score |

| 80 or higher (Dun & Bradstreet) | Good business credit score |

| 1 to 100 (Dun & Bradstreet PAYDEX) | 80 or above is considered a good score |

| 0 to 300 (FICO LiquidCredit Small Business Scoring Service) | Typical business credit score range |

A good business credit score is 76 or higher for Equifax or Experian, or 80 and above for Dun & Bradstreet24. The Dun & Bradstreet PAYDEX score ranges from one to 100, with a good score considered anything at 80 or above24. Business credit scores usually range between zero to 100, with the FICO LiquidCredit Small Business Scoring Service ranging between 0 to 30024.

Many business owners don’t know their business credit scores24. A Manta and Nav study found that 72% of business owners are unaware of their scores24. Knowing your business credit is key, as it can increase your chances of getting financing by 41%, according to the Nav American Dream Gap report24. Also, up to 25% of business credit reports may have errors or missing info, leading to wrong scores24.

Protecting your business credit is vital for a healthy profile and access to financing and opportunities25. The Small Business Administration suggests regularly checking both personal and business credit scores25. Shredding sensitive documents and maintaining good vendor relationships can also help protect your credit and ensure stable cash flow25.

By keeping an eye on and protecting your business credit, you set your company up for success. Taking steps to keep your info accurate, monitor your credit, and keep business and personal finances separate can help build a strong credit profile232425.

Common Business Credit Score Myths

Understanding business credit scores can be tough, with many myths out there. It’s often believed that personal and business credit are linked26. But, just starting a business doesn’t automatically build credit – you need to take action26. Knowing the truth about business credit scoring is key to keeping your company’s credit in good shape.

Many think a high personal credit score means a good business score. But, this isn’t always true26. Another myth is that your income level affects your credit score. But, income doesn’t play a role in credit score calculations26.

Some believe using debit cards hurts their credit score. But, debit card use isn’t reported to credit bureaus, so it doesn’t affect scores26. Also, many think not paying student loans won’t hurt their business credit. But, this is wrong – student loan defaults can harm your credit26.

Lastly, some think having a long-running business means a good credit score. But, building a strong credit profile takes effort27.

By clearing up these myths, business owners can make better choices to boost their credit. Understanding business credit scoring is vital for getting loans, better deals, and ensuring your business thrives.

Conclusion

Having a good business credit score is key for your company’s financial health. Knowing what affects your score, like payment history2829 and credit use29, helps. It opens doors to financing, lower insurance, and more growth opportunities282930.

It’s important to keep an eye on your business credit score. This helps you spot and clear up any credit score myths. Regularly checking your credit report and fixing any problems keeps your score strong282930.

A good credit score is between 670 and 850, FICO says2830. Scores over 800 are top-notch2830. By understanding the importance of credit score and using smart strategies, your business can thrive financially for years to come.

FAQ

What is a business credit score?

How are business credit scores determined?

What are the common business credit score ranges?

What is a good Experian Intelliscore Plus score?

What is a good Dun & Bradstreet PAYDEX score?

What is a good FICO SBSS score?

What are the benefits of a good business credit score?

How can I build and improve my business credit score?

Why is it important to monitor and protect my business credit?

What are some common myths about business credit scores?

Source Links

- What Is a Good Business Credit Score? | Nav – https://www.nav.com/resource/what-is-a-good-business-credit-score/

- What’s a good business credit score? – https://capitalise.com/gb/insights/Good-business-credit-score

- Business Credit Scores: What They Are, Where to Get Yours – NerdWallet – https://www.nerdwallet.com/article/small-business/business-credit-score-basics

- Guide to Business Credit Scores and Reports – https://fundbox.com/resources/guides/business-credit-score/

- The Factors That Influence Business Credit Scores | Nav – https://www.nav.com/blog/factors-of-business-credit-3552973/

- Top factors that impact your business credit score – https://www.experian.com/blogs/small-business-matters/2022/11/15/top-factors-that-impact-your-business-credit-score/

- What Is A Business Credit Score And How Does It Work? | Bankrate – https://www.bankrate.com/loans/small-business/building-better-business-credit-score/

- What are the Different Ranges of Credit Scores? | Equifax – https://www.equifax.com/personal/education/credit/score/articles/-/learn/credit-score-ranges/

- Experian Intelliscore FAQ – Business Credit Score Guide – https://northshoreadvisory.com/business-credit/business-credit-scores/experian-intelliscore-faqs/

- Decoding the Experian Intelliscore Business Credit Score | – https://www.creditsuite.com/blog/empower-your-business-by-decoding-the-experian-intelliscore-business-credit-score/?srsltid=AfmBOoqdnIVVo_Tp6cpW46bTDptRU30uuZTzO_XnL30AG7_rCuEMT1KN

- What Is a Good Intelliscore Plus Credit Score? – Credit Strong – https://www.creditstrong.com/what-is-a-good-intelliscore/

- PAYDEX Score: The Dun & Bradstreet Business Credit Rating – https://www.nav.com/business-credit-scores/dun-bradstreet-paydex/

- D&B PAYDEX Score FAQ – Business Credit Score Guide – https://northshoreadvisory.com/business-credit/business-credit-scores/dnb-paydex-score-faqs/

- What Is A Paydex Score? | Bankrate – https://www.bankrate.com/credit-cards/business/what-is-paydex-score/

- FICO® SBSS℠ Score — The Key SBA Loan Credit Score Explained – https://www.nav.com/business-credit-scores/fico-sbss/

- FICO SBSS FAQ – Credit Score for Small Business Loan – https://northshoreadvisory.com/business-credit/business-credit-scores/fico-sbss-small-business-credit-score/

- What Is A Good Credit Score? | Equifax® – https://www.equifax.com/personal/education/credit/score/articles/-/learn/what-is-a-good-credit-score/

- What Is a Good Credit Score? – Experian – https://www.experian.com/blogs/ask-experian/credit-education/score-basics/what-is-a-good-credit-score/

- What is a Business Credit Score and Why is it Important? – https://www.synovus.com/business/resource-center/managing-your-money/whats-a-business-credit-score/

- How to increase your business credit score in 5 steps – Funding Circle – https://www.fundingcircle.com/us/resources/how-to-increase-your-business-credit-score/

- How to Get and Build Business Credit – https://www.nerdwallet.com/article/small-business/how-to-build-business-credit-small-business-loans

- 6 Tips and Best Practices to Build Business Credit – https://www.altcap.org/resources/how-to-build-business-credit-6-tips

- How to maintain and grow a healthy business credit score Experian – https://www.businesscreditfacts.com/pdp.aspx?pg=how-to-maintain-and-grow-a-healthy-business-credit-score

- Business Credit Scores and Reports | Nav – https://www.nav.com/business-credit-scores/

- How to Protect Your Business Credit – https://www.uschamber.com/co/run/finance/how-to-protect-your-business-credit

- Does checking your credit score lower it? Plus 12 other common credit score myths debunked – https://www.cnbc.com/select/credit-score-myths-debunked/

- Impacts on Business Credit – Business Credit Myths – https://northshoreadvisory.com/business-credit-blog/impacts-of-business-credit/6-worst-business-credit-myths/

- What Is a Credit Score? Definition, Factors, and Ways to Raise It – https://www.investopedia.com/terms/c/credit_score.asp

- Why Is Good Credit So Important? | Bankrate – https://www.bankrate.com/credit-cards/advice/why-is-good-credit-so-important/

- What is a Good Credit Score and How Can You Get One? – https://www.houzeo.com/blog/what-is-a-good-credit-score/